401k loan calculator fidelity

A Retirement Calculator To Help You Discover What They Are. Fidelity 401k loan calculator.

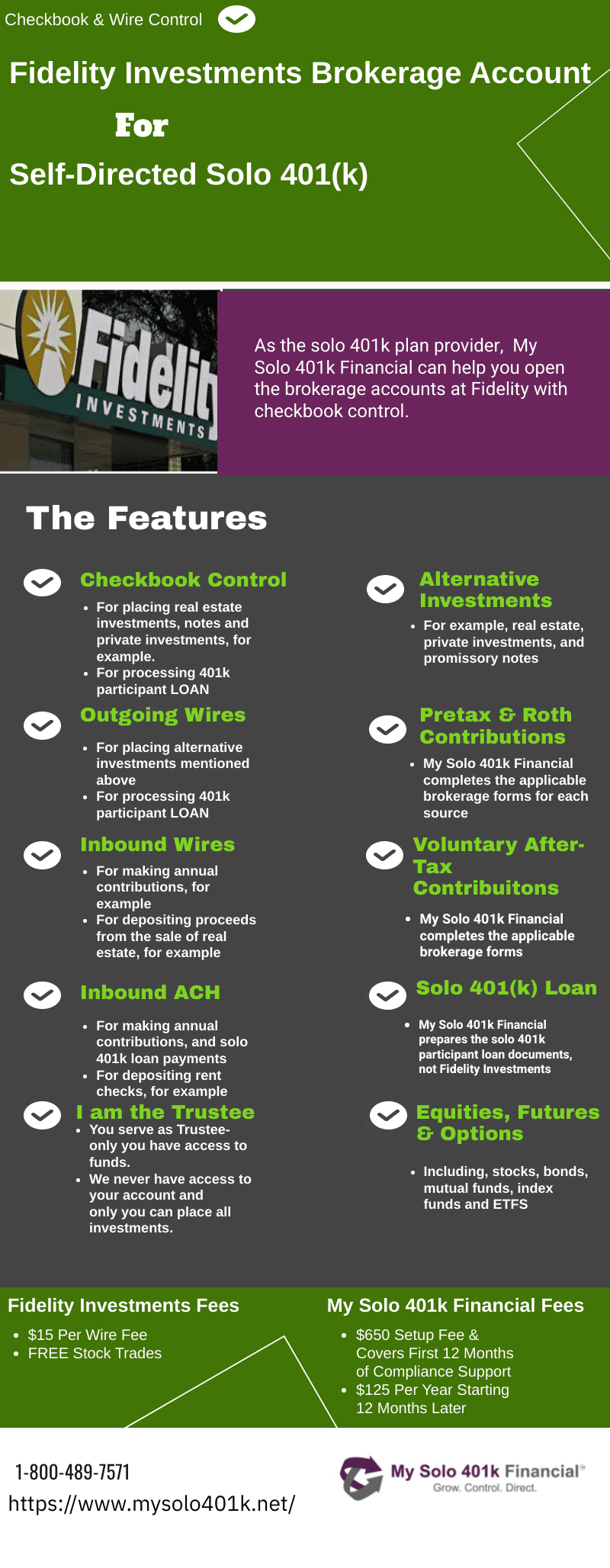

Fidelity Solo 401k Brokerage Account From My Solo 401k

What is a 401k.

. Free service that wont affect your credit. A 401 k match is an employers percentage match of a participating employees contribution to their 401 k plan usually up to a certain limit denoted as a percentage of the employees salary. If you need to tap into retirement savings prior to 59½ and want to avoid an early distribution penalty this calculator can be used to determine the allowable distribution amounts under code 72 t.

Your total is 756477 after 35 years. 401 kGetting Ready to RetireLife EventsLiving in RetirementSocial Security. First all contributions and earnings to your 401 k are tax-deferred.

Your loan payment will be 53906. This easy-to-use interactive calculator helps you quickly bucket expenses and determine your monthly surplus or deficit. 401 k College Planning Estate Planning Financial Planning Getting Ready to Retire Insurance Investing Strategies Investing in Bonds Investing in Stocks Living in Retirement Saving and Spending.

Basic accounts require 15 monthly fee and 360 setup fee. A 401k loan is a way for someone to access cash from their 401k without tax consequences because the money is in the form of a loan. The Planning Guidance Center helps make it easy to get a holistic view of your financial plan from one place.

A 401k is a workplace savings plan that has tax advantages as an incentive to invest for. Best Online Brokers for Stocks. With this tool you can see how prepared you may be for retirement review and evaluate different investment strategies and get a report with clear next steps for you to consider.

This calculator uses monthly compounding and monthly payment frequency. Use the Contribution Calculator to see the impact of changing your 401k contribution. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance.

Second many employers provide matching contributions to your 401 k account. You may apply for a loan by calling Fidelity at 8003430860. Conveniently access your Fidelity workplace benefits such as 401k savings plans stock options health savings accounts and health insurance.

Planning Guidance Center. Ad A Retirement Calculator To Help You Plan For The Future. Obtain an estimate of what you could afford to borrow with a Fidelity Personal Loan.

Use the Contribution Calculator to see the impact of changing your 401k contribution. Get your personal loan results today. For more information or questions please contact us by phone at 1-800-388-4380 or email us at Fidelity at fddbank dot com Footer Information Call Us.

Current faculty and staff who are a participant in the Plan are eligible to take a loan against their voluntary pre-tax account balance held at Fidelity. Use this 401k loan calculator to help calculate your 401k loan payments. Even 2 percent more from your pay could make a big difference.

The combined result is a retirement savings plan you cannot afford to pass up. This calculator is for educational use only illustrating how different user situations and decisions affect a hypothetical retirement income plan and should not be the basis for any investment or securities product purchase decisions. You only pay taxes on contributions and earnings when the money is withdrawn.

Use this calculator to see how much more you could accumulate in your employer retirement plan over time by increasing the amount that you contribute from each paycheck. Shop smart with our fast and simple form. Support for 401 loans and Roth contributions.

There can be no match without an employee contribution and not all 401 ks offer employer matching. Option for upgraded account that includes free wire transfers checks tax form filing and other features. Your payments add up to 3234367.

A 401k is a workplace savings plan that has tax advantages as an incentive to invest for. How To Apply For A Loan. Best Brokers for Low Fees.

The total of payments includes interest of 234367 over the life of the loan. Please be advised that these are indicative amounts and may change based on the Fidelity Banks credit risk assessment. Ad Shop low fixed rates for good and excellent credit.

As an example an employer that matches 50 of. This 401k loan calculator works with the user entering their specific information related to their 401k. Best Ways to Invest 30K.

Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the first 3 percent of pay contributed and 50 percent of the next 2 percent of pay contributed. How This 401k Loan Calculator Works. What is a 401k.

Well what you need is a 401k loan calculator repayment tool. Estimated withdrawal amounts are simulations based on historical asset class returns and are not recommendations. Pre-tax Contribution Limits 401k 403b and 457b plans.

Ad Compare 2022s Best Merchant Cash Advance Loans Find the Best Option for Your Business.

Retirement Calculators Tools Fidelity Retirement Calculator Fidelity Retirement Saving For Retirement

Roth 401k Roth Vs Traditional 401k Fidelity

Financial Calculators Tools Fidelity

Fidelity S Retirement Calculators Can Help You Plan Your Retirement Income Savings And Assess Your Financial Health Fidelity

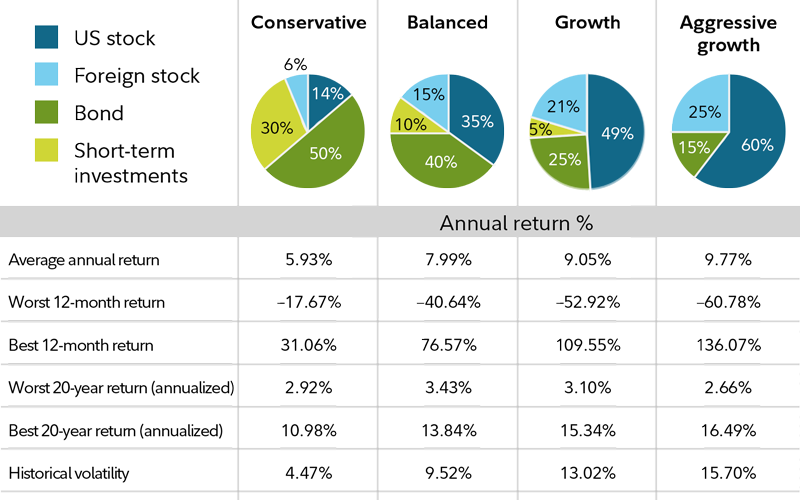

Risk Tolerance And Time Horizon Fidelity

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

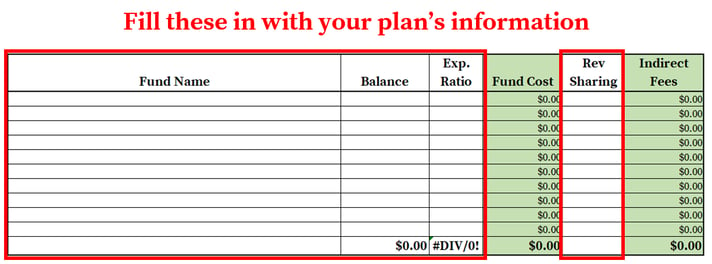

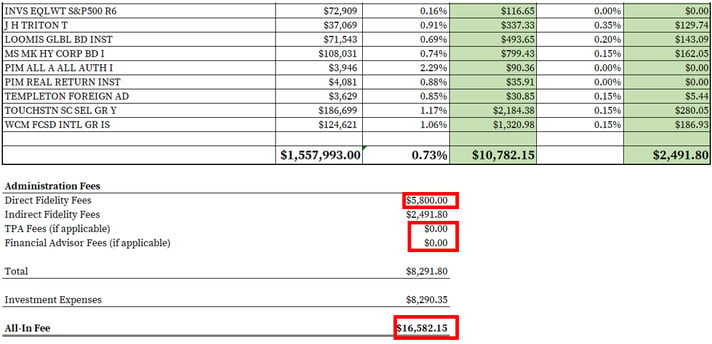

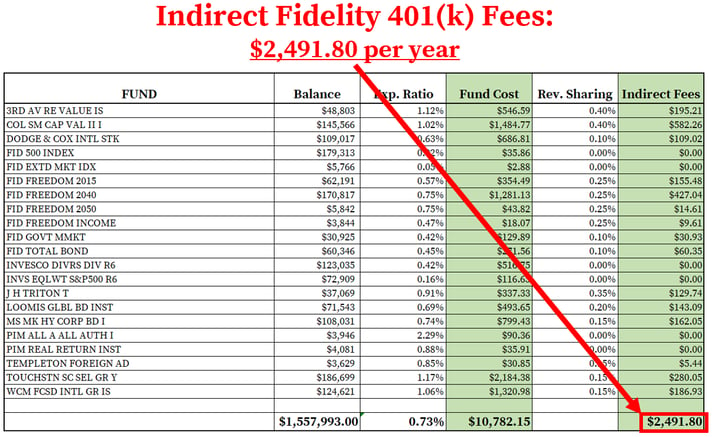

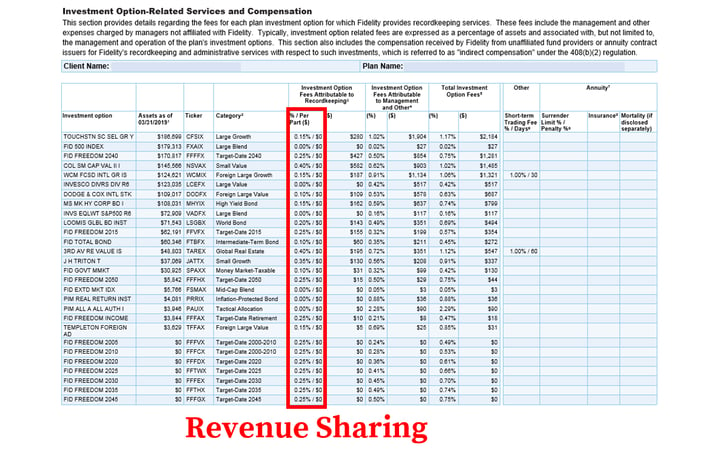

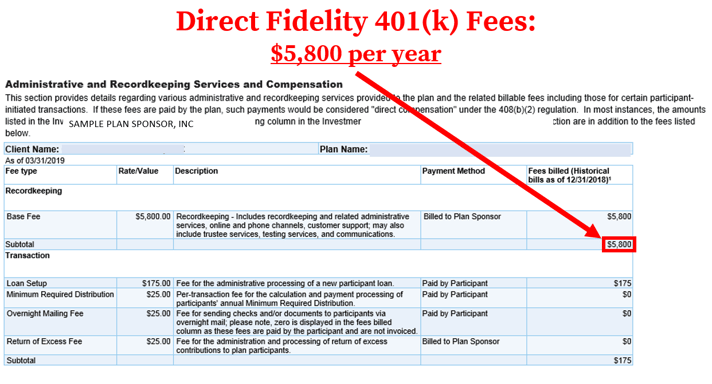

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

How To Process A Fidelity Investments Conversion Of Voluntary After Tax Solo 401k Funds Non Prototype Account To A Fidelity Roth Ira My Solo 401k Financial

How To Find Calculate Fidelity 401 K Fees

Fidelity Go Review Pros Cons And Who Should Set Up An Account

How To Find Calculate Fidelity 401 K Fees

How To Find Calculate Fidelity 401 K Fees

After Tax 401 K Contributions Retirement Benefits Fidelity

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

How To Find Calculate Fidelity 401 K Fees